How to Make Your Content Marketing Simply Irresistible

What’s the content you just can’t resist? Each of us has a soft spot – “how to” stories, “why” stories, or stories about a hero overcoming the forces of evil against all odds.

What’s irresistible differs for you and me − and for each of your buyer personas. The better you understand your customers, the more irresistible you can make your content marketing.

That’s why you must look at content through the eyes of your audience. Find out what they want to know and serve it up to them. Figure out where they’re going and show up there.

In his book Brandscaping, Andrew Davis asks 27 insightful questions. While reading his book, I found myself highlighting these questions at the end of each chapter.

Four of Andrew’s questions in particular can help you discover what’s relevant, what’s valuable and what’s irresistible for your readers.

How can we identify what content is valuable to our audience?

What content does our audience already have a relationship with and how can our brand embrace it?

Who already owns our audience?

What products or services do our customers buy before they have a need for our wares?

Good buyer persona research enables you to answer these questions confidently.

Now that media consumption is so fragmented, it’s critical to learn buyers’ information habits. You need to understand the exact pieces of information they seek out – based on the questions they raise at each step in the buyers’ journey. You can help customers through the buying process by offering content marketing with the answers to address their urgent questions.

Unfortunately, many marketers don’t use buyer personas. Instead they make up stuff based on demographics or other existing information, rather than interviewing actual customers. Or, they have a buyer persona, but don’t actually use the buyer persona day to day – perhaps because it’s not insightful enough.

About 44% of marketers have buyer personas, yet 85% don’t use them effectively, says Adele Revella of the Buyer Persona Institute. Here’s an approach to creating B2B buyer personas.

Recycling existing information into the format of a buyer persona doesn’t cut it, she warns. The whole point of a buyer persona is to gain new insights, to harvest new information that addresses Andrew’s questions above so you can see through buyers’ eyes.

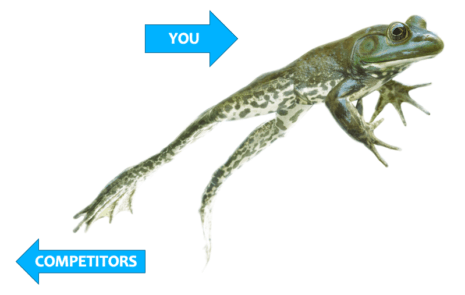

One marketer who’s nailing irresistible content is Discover Financial Services. In a market dominated by Visa, MasterCard and AmEx, Discover found a way to stand out from other credit cards with personalized content that’s simply irresistible.

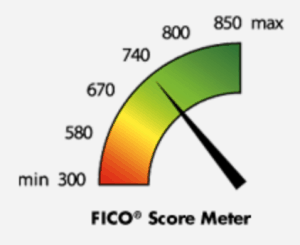

Each time you interact with Discover, the company proactively shares your FICO Credit Score, a credit rating that banks and financial institutions use to measure creditworthiness. American lenders look up your FICO score before deciding whether to provide you a loan, a mortgage or a line of credit.

While FICO scores are available free to U.S. consumers under the law, Discover proactively shares them, which saves you the hassle of making a FICO score request. Discover makes it easy to track your credit score month to month, which is important because 83% of FICO scores change monthly.

Discover provides your FICO score:

• On your monthly bill. Imagine: What personalized information could you share with customers in an invoice, to go beyond how much they owe?

• On your personalized web page. Imagine: What’s the personalized information your customers would find valuable when they log in … such as the status of a recent order?

• In direct mailings that cross-sell other services. Imagine: What personalized information could you offer that would prompt customers to consider your other offerings?

What’s your credit score? And what does it mean? Not only does Discover share your score, the company provides a context around it by answering these consumer questions:

• What is a FICO Credit Score?

• Why do we provide your free FICO Credit Score?

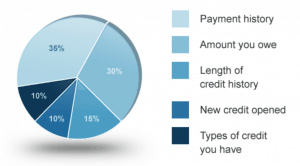

• How is a FICO score calculated?

• Does my FICO Credit Score change every month?

• How often will my FICO Credit Score be available?

• Will receiving this affect my credit score?

• Where can I find out more about my credit?

• How do I improve my FICO score?

While this kind of added value is not something you’d expect from big players, it’s a golden idea for a challenger brand like Discover.

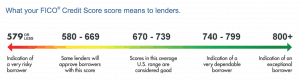

Discover goes a step further by providing simple graphics to make your FICO score easier to understand, as you see here. One graphic shows the factors that go into calculating your score. Another shows how lenders view your score. And your actual FICO score appears in a speedometer format that’s easy to scan and understand.

A couple of banks offer free FICO scores today, including Barclaycard US and First Bankcard. Others plan to join Discover in offering credit scores, including JPMorgan Chase, Bank of America, Ally Financial and USAA.

Making FICO scores part of everyday interactions “so you can stay on top of your credit and avoid surprises,” as Discover says, is spot on. It’s a way to unlock relevant, valuable, irresistible content for Discover’s customers – a brilliant stroke of personalized content marketing.

What content could you offer that customers would find simply irresistible?

Contact Us